Latest News & Insights

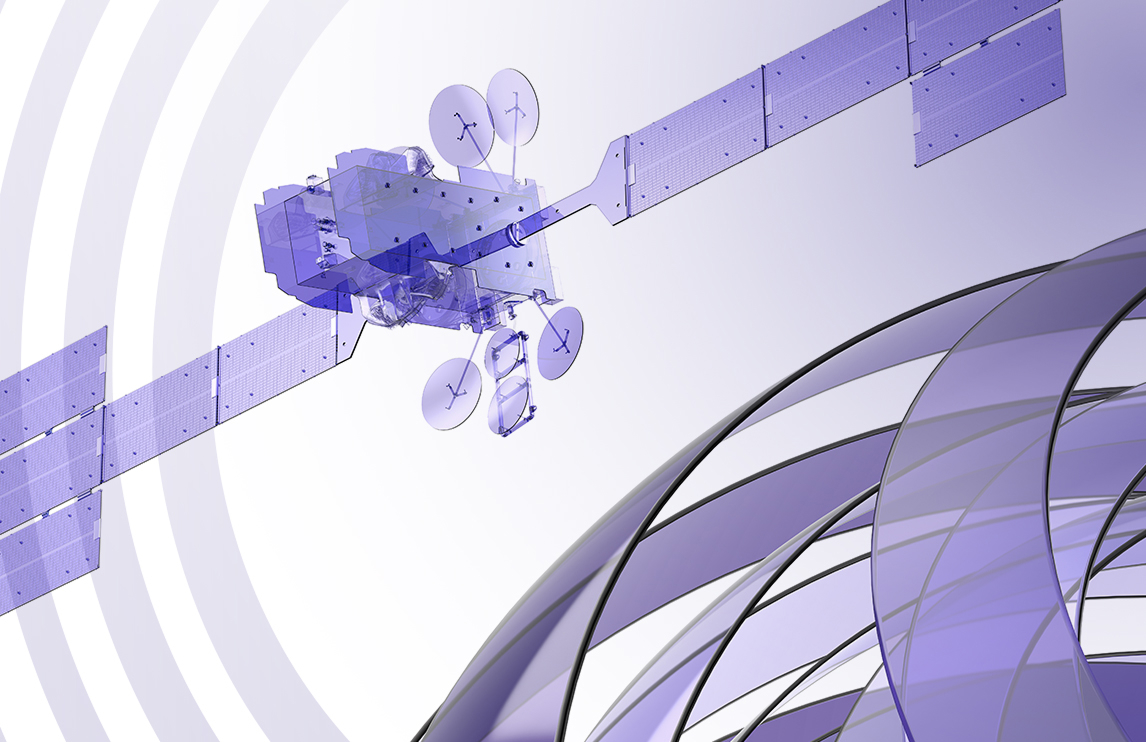

Ready to Soar

News John Nishimoto Launching a bold brand for a new era in space Today marks the exciting launch of the new SES — a multi-orbit European satellite connectivity provider and pioneer of space-enabled communications. Earlier this year, SES acquired Intelsat, an international satellite company with a range of integrated terrestrial and space solutions. Under the […]

-

Insight

InsightPrivate Equity Is Not So Private Anymore

Ever since it first came into prominence in the 1940s, the private equity industry has undergone significant transformation. Industries like healthcare, tech and infrastructure have experienced staggering amounts of development, growing the private equity industry’s AUM by over US $6 trillion in the past two decades alone [...]

-

News

NewsAlex Reid Named Partner at Sequel

We’re proud to announce that Alex Reid has been named Partner at Sequel. Since joining Sequel eight years ago, Alex has served as our Head of Strategy & Research, helping to shape client engagements, build our Strategy team, and deepen our capabilities in insight-led brand development [...]

-

Insight

InsightFrom Promise to Performance: How to Connect Your ESG Report with Your Brand Platform

Navigating the ESG Backlash In today’s corporate landscape, ESG (environmental, social, governance) has come under significant scrutiny. In fact, mentions of ESG on earnings calls have dropped from 155 companies in the S&P 500 in Q4 2021 to just nine direct mentions in Q1 2024. Organizations are increasingly distancing themselves from this politically [...]

-

News

NewsOfficially recognized as a woman-owned enterprise, Sequel is proud to be part of a nationwide movement!

In the spirit of celebrating women leaders in our industry and in business overall, we’re extremely proud to announce our official recognition as a certified woman-owned enterprise by the WBENC (Women’s Business Enterprise National Council) [...]

-

News

NewsSequel nominated for Global Brand Architecture & Naming Strategy excellence at the Transform Awards 2023

The Transform Awards North America are in their ninth year of celebrating excellence in rebranding and brand strategy. The awards recognize best practices in corporate, product and global brand development work, with categories that focus on content, execution, evaluation and strategy [...]

-

Insight

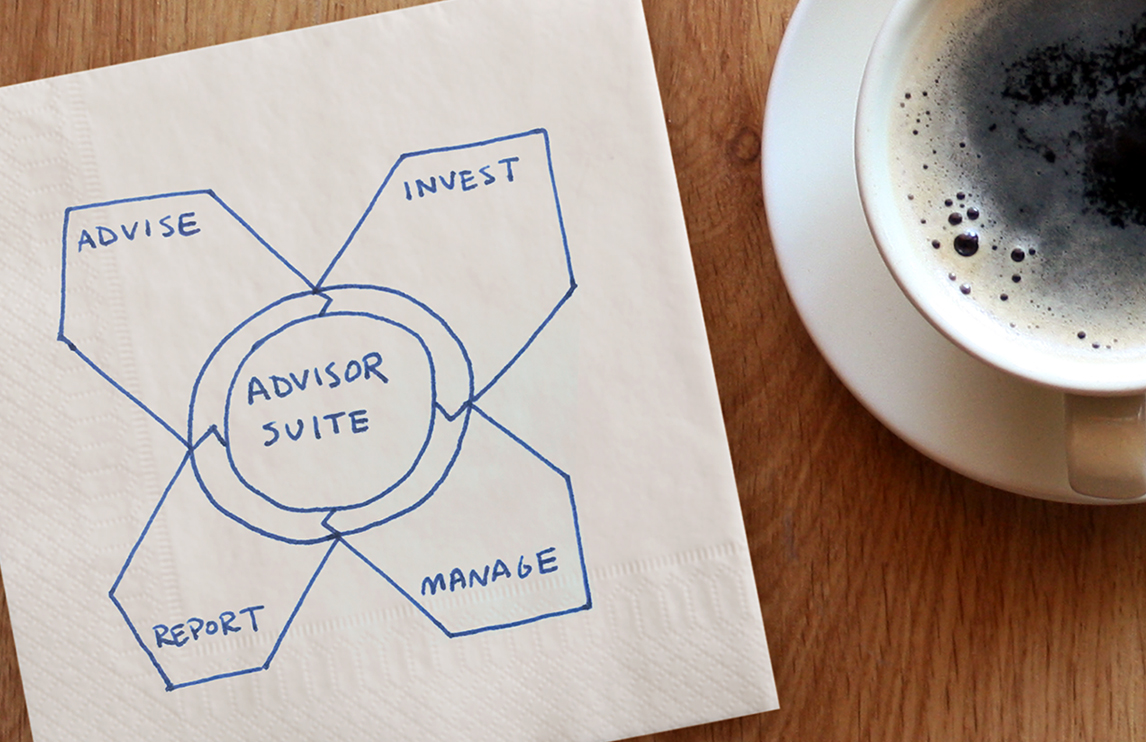

InsightImagine capturing the big picture of your value — your pitch — in a single, clarifying graphic.

Visualize your value proposition. We all know that storytelling is not simply verbal. Your business narrative needs more than just word cues, data points or revelatory insights. People respond to visuals that help them grasp the full story, especially ones that look and feel proprietary, and that harness a few words […]

-

News

NewsStepping up on the path to ending Alzheimer’s

We’re gathering in Brooklyn on September 23rd to walk the Brooklyn Bridge and back, spending the day raising funds and celebrating life and the quest for a cure to end Alzheimer’s. Check us out on social media as we make this a walk to remember! The scourge of Alzheimer’s takes the […]

-

News

NewsEnvisioning a new path to wellness for the local Rockaway community

Over these last several months, the effects of this global pandemic have been devastating for many New Yorkers. One of the communities hardest hit with an ongoing surge of Covid case numbers is in the Rockaways. Already struggling with the difficulties of a lack of available resources and services, plus environmental […]

-

Insight

InsightDevelop your brand narrative in PowerPoint? Never. Until it really works.

Steve Jobs hated it. Marketers and business executives want to leave it behind. Savvy salespeople might cherry-pick a page or two but abandon the deck. And designers run for the hills. The haters of PowerPoint see it as a presentation crutch or, at the very least, the reason why your meetings always run over […]

-

Insight

InsightCSR? ESG? GRI? What people really want is your POV.

Creating a content platform that does more than report on your impact. People want to know the impact you’re having on them and the world. And more and more, investors, business partners, employees and customers want more than just information. It’s no longer enough to pull together a smart set of key […]

-

News

NewsCrafting a more perfect union: A pint with a purpose

Rockaway Brewing Company (RBC) has taken the pledge! In support of the “People Power Beer” movement, RBC will be releasing a People Power beer in an effort to inspire people across New York city — and specifically the Rockaways — to unite and combat the range of injustices plaguing our nation. Please join them […]

-

Insight

InsightWhat’s next when your brand graduates from Harvard?

For more than 20 years, the Harvard Clinical Research Institute (HCRI) has been a leader in cardiac and other device and drug studies, helping to advance health and quality of life around the world. And, while the HCRI name showcased its relationship with the Harvard Medical School, it also hampered its […]

-

News

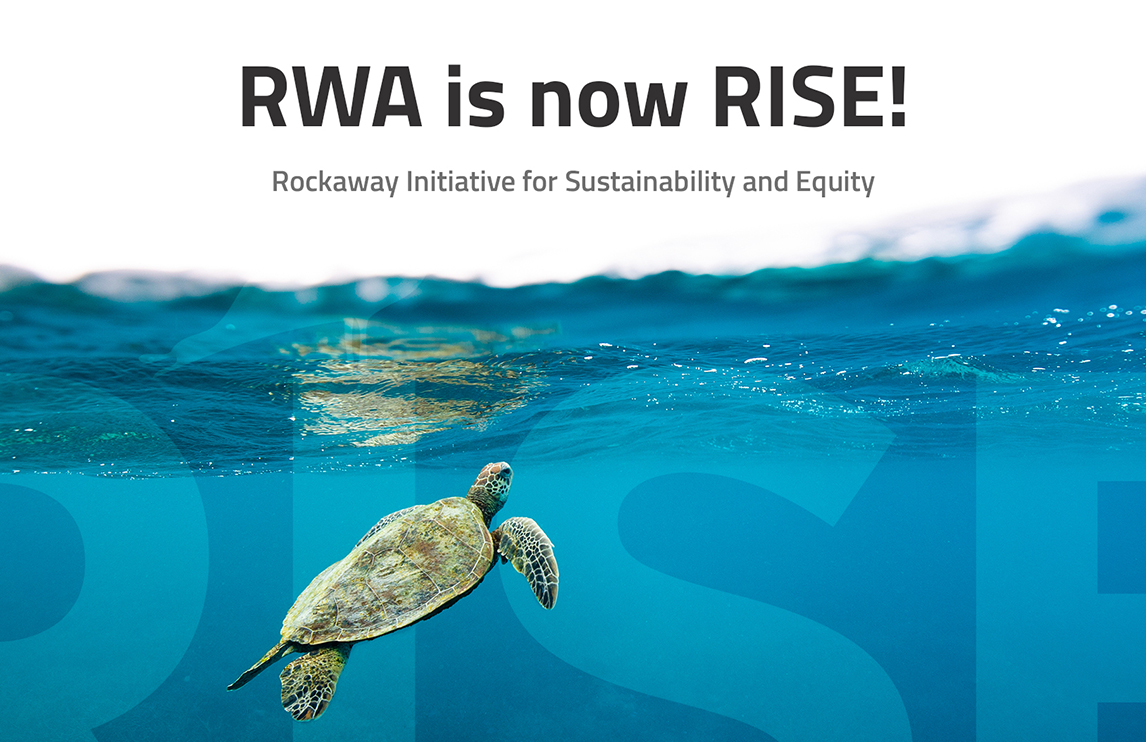

NewsThe RISE of a new brand: Revitalizing a cultural and educational center for local families

When the Rockaway Waterfront Alliance (RWA) first engaged Sequel, they were trying to evolve beyond the limits of their initial organizational reputation. The nonprofit was founded in 2005 as a means to promote environmental awareness around the waterfronts of New York’s Rockaways, primarily through programs for elementary and high school […]

-

Insight

InsightThe power of five: Promoting confidence in your brand

Right now, every business has felt or continues to feel it: Spending is down. Skepticism among consumers, employees and shareholders is high. Marketers are unsure how to best leverage the limited resources they have, but they recognize times of uncertainty are opportunities to increase market- and mind-share. Where to start? Let’s assume […]

-

Insight

InsightSmart CMO: Excel, beat the odds and become a C-suite star.

As a CMO, you may often feel there’s a target on your back. You’re under constant pressure to achieve results, especially in a challenging economy — yet those results can be hard to quantify with the precision other executives are able to summon. It’s no wonder that the average CMO’s tenure lasts […]

-

News

NewsSequel wins Graphis design and UX award for best websites.

For over 70 years, Graphis has been internationally recognized for showcasing outstanding design, advertising and photography from around the globe. This year, Sequel was one of only a select number of agencies chosen from a vast pool of entries as having achieved excellence in visual and interaction design in the digital […]

-

News

NewsSequel partners with HELP/PSI to reactivate its brand and digital presence.

New York, NY — Strategic branding and digital agency Sequel today announced a partnership with HELP/PSI to reposition and rebrand the New York City–based community healthcare services organization. Serving more than 13,000 individuals and families through their 13 locations, HELP/PSI targets underserved communities throughout the Bronx, Brooklyn, Manhattan and Queens. As […]

-

News

NewsRockaway Brewing Company identity & packaging wins at international creative competition.

As a mainstay in the celebration and curation of world-class design and creativity, Graphis has chosen Sequel as an award-winner for its brand development and design program for the local craft brewery aptly named Rockaway Brewing Company. We’re super excited that a start-up brand and identity that we all love […]

-

News

NewsReinvented careers site attracts fresh talent to a centuries-old global bank.

Founded in 1856, Credit Suisse has grown into a global private and investment banking behemoth with operations in more than 50 countries and 48,200 employees from more than 150 different nations. But their online efforts to recruit new talent — essential to the bank’s ongoing evolution and success — were hampered […]

-

News

NewsRecognizing breakthrough creative across international borders

In August 2019, Sequel Creative Director David Phan had the honor of acting as a judge at MerComm Inc.’s ARC Awards. Dubbed the “Academy Awards of annual reports” by the financial media, the ARC Awards is the world’s largest international competition honoring excellence in annual reports and corporate communications. “In times […]

-

News

NewsReenvisioning the digital brand experience for a financial icon

Founded in 1982 as an equity research firm, Baron Funds built its reputation on delivering growth equity investment solutions scaled to the long-term investor. Over the years, the business evolved to serve the needs of advisors, institutions and individual clients. At the time of our engagement, the firm had two separate […]

-

Insight

InsightMumbling louder is not a branding strategy.

As we’re all aware, the digital age has given us the ability to reach an enormous audience quickly and more frequently. Through RSS feeds, Twitter and the older standbys of email and websites, a world’s worth of consumers has become a viable, and fairly instantaneous, target. But, while these digital devices […]

-

News

NewsMSC Industrial and Sequel create a new branded corporate campus experience.

MSC Industrial Supply Co. (NYSE: MSM), the premier national distributor of maintenance, repair and operations (MRO) products and services, collaborated with Sequel to translate the MSC brand into a visitor experience for their new corporate campus in Davidson, North Carolina. The new multi-use, six-story facility houses more than 750 employees (associates) […]

-

Insight

InsightHidden opportunity: Use every project to build your brand.

Business leaders have always raised an eyebrow when it comes to the ROI of enterprise-wide branding programs. These programs are multiyear, multi-million-dollar expenditures that look and feel great, but are not seen as contributing to short-term capture of new revenue / market share or short-term business results. In light of current economic doldrums, marketers […]

-

Insight

InsightFor those who call it just “look-and-feel” — think again. Think VIBE.

Merriam and Webster agree that the word “vibe” means a feeling or spirit that someone or something gives you. The Urban Dictionary echoes that, adding, “a distinctive emotional atmosphere.” So when a project manager at a large global brand consultancy handed out a project status sheet with lots of narrow columns and […]

-

Insight

InsightBrand loyalty: Where do you stand?

Thriving in the new economy demands building and preserving brand loyalty. But how, really, does your brand measure up — with customers, investors, employees and others? Understanding where you stand now is essential to knowing what to do next, and to evaluating your progress as you build your enterprise and increase the […]

-

Insight

InsightAll in! Engaged employees are essential to growth.

Companies often like to say that people are their “most important asset” — after all, how many times have you read that phrase in an annual report? The problem is, not all companies behave as if they really mean it. In this particular economic climate, that could be their loss. While it […]

-

News

NewsA moment for all of us to be proud!

Our collaborative vision for a new digital presence and video storytelling for one of Sequel’s most purpose-driven clients, Proud Moments, was honored by the internationally recognized MarCom Awards. Proud Moments provides best-in-class therapy and clinical services for children and families with autism. With over 40 locations as well as on-site clinical […]

-

Insight

InsightReflecting compassion and care through a new brand

The goal of Proud Moments, a behavioral health agency that uses applied behavior analysis (ABA) therapy, is to help children diagnosed on the autism spectrum thrive. So, when they engaged Sequel to refresh their branding and update their website, we made it our goal to create a brand that reflected the hope, optimism and positivity that Proud Moments is all about [...]

-

Insight

InsightA brief conversation with Dana Gonsalves

Creative Director and culture-builder, Dana has been one of our creative and cultural leaders since 2001. Her passion for great ideas, great design and great food has made her one of the reasons Sequel is what it is. And her homemade holiday cookies that she shares with the team every year aren’t so bad either [...]